For the most part, listings on hold can still be seen by appointment.

Showing posts with label the business of real estate. Show all posts

Showing posts with label the business of real estate. Show all posts

Tuesday, March 17, 2020

Corona virus impact

Not much of a surprise ... in the last 24 hours 85 listings have been put on hold and an additional 25 have been cancelled.

For the most part, listings on hold can still be seen by appointment.

For the most part, listings on hold can still be seen by appointment.

Wednesday, July 10, 2019

Our Little Corner of the World IS Different

Intuitively, true San Franciscans know this is true. We're different; we're unique ...

I found an example in one of the social media items they put out from time-to-time that they encourage agents to use.

When I first saw this I said to myself "this doesn't seem to fit our market in San Francisco." Myself replied: "prove it."

OK, here it is. Looking at single family home sales in district 2 (the Sunset) since 1/11/2019 there were a total of 174 closed transactions:

The average selling price for the 30 owner occupied properties was $1.476 million (19 DOM).

The average selling price for the 8 tenant occupied properties was $1.294 million.(38 DOM).

The average selling price for the 136 vacant properties was $1.695 million (20 DOM).

So for this sample, "vacant" is the clear winner with highest average sales price and virtual tie for the shortest days on market.

I found an example in one of the social media items they put out from time-to-time that they encourage agents to use.

When I first saw this I said to myself "this doesn't seem to fit our market in San Francisco." Myself replied: "prove it."

OK, here it is. Looking at single family home sales in district 2 (the Sunset) since 1/11/2019 there were a total of 174 closed transactions:

The average selling price for the 30 owner occupied properties was $1.476 million (19 DOM).

The average selling price for the 8 tenant occupied properties was $1.294 million.(38 DOM).

The average selling price for the 136 vacant properties was $1.695 million (20 DOM).

So for this sample, "vacant" is the clear winner with highest average sales price and virtual tie for the shortest days on market.

Wednesday, October 24, 2018

Real Estate Brokerage -- More Consolidation

From RISMedia:

Realogy announced today it will be expanding its portfolio of brand offerings, franchising Corcoran® and Climb Real Estate® for the first time and selling agreements as early as 2019. The Realogy portfolio currently includes Better Homes and Gardens® Real Estate, CENTURY 21®, Coldwell Banker® and Coldwell Banker Commercial®, ERA®, and Sotheby’s International Realty®.

The San Francisco-based Climb brokerage sold itself to Realogy in 2016 so this franchising isn't technically consolidation. But the Corcoran deal certainly is.

Presumably, this is (at least part of) Realogy's strategy to counter other growing brokerages and real estate sales business models such as Compass, REXX and Zillow Offers.

Friday, September 28, 2018

More Real Estate Brokerage Consolidation

Just a month ago we got the news that Compass was gobbling up Pacific Union and Paragon brokerages, we've just realized that Hill & Co is being acquired by Alain Pinel.

The difference between the two acquisitions seems to boil down to Hill management wanting to retain its "family owned" reputation. According to its president, Jay Costello, Hill had been approached by Compass but turned them down. Alain Pinel has over 800 agents compared to Hill's 80. However, a check of the state Department of Real Estate web site shows just 38 Hill agents and brokers.

The full story and perspective is available at the San Francisco Business Times.

The difference between the two acquisitions seems to boil down to Hill management wanting to retain its "family owned" reputation. According to its president, Jay Costello, Hill had been approached by Compass but turned them down. Alain Pinel has over 800 agents compared to Hill's 80. However, a check of the state Department of Real Estate web site shows just 38 Hill agents and brokers.

The full story and perspective is available at the San Francisco Business Times.

Friday, August 24, 2018

Saturday, July 7, 2018

The Missing Piece in Electronic Signing for Real Estate Transactions

Below is a link to a blog post by a company (new to me) called "Notarize". They have created a system to facilitate on-line signing and notarizing of documents -- "notarizing" being the operative word.

Although we've been able to do listing and selling of real estate with electronically signed documents for some time, the missing piece has been the final closing documents, including loan documents, that traditionally are signed in person at the escrow/title office.

It's not clear whether electronic signing of loan documents is or will be acceptable to lenders and/or county recorders.

But it seems inevitable that's the direction we're headed.

Although we've been able to do listing and selling of real estate with electronically signed documents for some time, the missing piece has been the final closing documents, including loan documents, that traditionally are signed in person at the escrow/title office.

It's not clear whether electronic signing of loan documents is or will be acceptable to lenders and/or county recorders.

But it seems inevitable that's the direction we're headed.

Thursday, March 29, 2018

Chinese investment in commercial real estate down

Article on BISNOW. I wonder if this will translate into less Chinese investment in residential real estate in the U.S.?

Click on the link above for the full article.

Click on the link above for the full article.

Saturday, June 10, 2017

Why Listings Don't Sell

Occasionally we see property listings that are "still available", or "price reduced" and its various euphemisms ("price improved", "price adjusted" etc). There's an interesting article in RISmedia that attempts to outline the major reasons why listings don't sell

The number one reason: "You overvalued your property". I would word it a bit differently: "Your property is overpriced given it's current condition" which takes into account reasons 5-10:

The number one reason: "You overvalued your property". I would word it a bit differently: "Your property is overpriced given it's current condition" which takes into account reasons 5-10:

- You haven't had your home professionally cleaned. A dirty house is going to leave a bad impression on buyers. Make sure you have a professional clean your carpeting and windows before you begin showing your house.

- You haven't staged your home. If you've already moved out, then don't show an empty house. This makes it difficult for buyers to imagine living in it. Stage your house with furniture and decor to give buyers a better idea of how big every room is and how it can be used. You want the buyer to feel at home when they are taking the tour.

- You kept up all of your personal décor. Buyers are going to feel uncomfortable touring your house if you keep all of your family portraits up. Take down your personal décor so that buyers can have an easier time imagining themselves living there.

- Your home improvements are too personalized. You might think that the comic book mural you painted for your child's room is absolutely incredible, but that doesn't mean potential buyers will agree. If your home improvements are too personalized, it can scare off buyers who don't want to pay for features they don't want.

- Your home is too cluttered. Even if your home is clean, clutter can still be an issue. For example, maybe you simply have too much furniture in one of your rooms. This can make the house feel smaller than it is.

- Your home is in need of too many repairs.

It may seem counter intuitive that in a seller's market such as we have in San Francisco right now, but 5-10 matter. In our market where the majority of listings sell for over asking, many buyers and agents who perceive your property is over priced won't even consider offering something less. Better to slightly under price your property and let the market and competitive offers decide.

After all, there is truth to the old adage: a property is only worth what a buyer is willing to pay for it.

Monday, August 15, 2016

The Ethics of Real Estate Photography

This is a big topic but here, in one screen grab, sums up my take (pardon the pun) on it.

A newish company in the real estate listing photography business is offering two "enhancement services". 1. They will add a blue sky to a photo instead of the gray sky that was there the day the photos were taken. 2. They will turn the brown lawn green. They normally charge extra for these services but during this promotion they are free.

In my view, one of these is OK and the other isn't.

We don't always have the luxury of photographing a listing on the perfectly sunlit day. Adding a blue sky enhances the photo without changing the presentation of the property. On certain days there will be a beautiful blue sky above; on other days there won't. In any case the sky it's not part of the sale.

On the other hand, the brown lawn is going to be there until the season changes or new sod is installed. It's part of the sale. You could argue that the lawn will be green in the spring. Maybe or maybe not. And, the prospective buyer is going to see the brown lawn as soon as they arrive at the showing. What message does that send? What other edits or "enhancements" have been made in the marketing materials? What other important information about the property is the seller/listing agent trying to hide or misrepresent?

A newish company in the real estate listing photography business is offering two "enhancement services". 1. They will add a blue sky to a photo instead of the gray sky that was there the day the photos were taken. 2. They will turn the brown lawn green. They normally charge extra for these services but during this promotion they are free.

In my view, one of these is OK and the other isn't.

We don't always have the luxury of photographing a listing on the perfectly sunlit day. Adding a blue sky enhances the photo without changing the presentation of the property. On certain days there will be a beautiful blue sky above; on other days there won't. In any case the sky it's not part of the sale.

On the other hand, the brown lawn is going to be there until the season changes or new sod is installed. It's part of the sale. You could argue that the lawn will be green in the spring. Maybe or maybe not. And, the prospective buyer is going to see the brown lawn as soon as they arrive at the showing. What message does that send? What other edits or "enhancements" have been made in the marketing materials? What other important information about the property is the seller/listing agent trying to hide or misrepresent?

Tuesday, June 7, 2016

Busines Times Rankings

Our company, Berkshire Hathaway HomeServices--Drysdale Properties, has been ranked #15 of 25 companies by gross sales in 2015. We're #6 when ranked by number of properties sold!

Tuesday, April 12, 2016

News that makes us feel good

A bit of great news about our brokerage: RealTrends publishes statistics for residential real estate brokerages nationally and within this year's report Berkshire Hathaway HomeServices Drysdale Properties is in the top ten brokerages based in Northern California and in the top 100 (92nd, actually) nationwide.

Great to be part of such a growing, dynamic, locally-owned company!

Great to be part of such a growing, dynamic, locally-owned company!

Wednesday, February 3, 2016

Report Methodology

From time to time we get questions about the methodology behind the reports we publish. Here's a little background:

Over the years as our clients

became more tech-smart and sophisticated, our data collection has also

evolved.

Monthly Sales Reports

Today, we conduct a monthly

survey of San Francisco and Marin counties residential real estate markets looking at sales and current listings. In San Francisco our survey covers

approximately 61% of all residential sales (single family homes, condos, co-ops

and TICs plus 100% of 2-4 unit residential buildings). In

Marin we survey approximately 75% of all residential sales (single family homes and condos.

One of the features that sets

our surveys apart from most published statistics is that we focus on the

most common/popular configurations of homes (for example: 2 bedroom, 1 bath

single family homes; 1 bedroom, 1 bath condos).

This gives a truer picture of changes in the market than averages that

include all residential properties, especially since we have some very

expensive homes in both counties that would otherwise skew results. It’s especially helpful for buyers and

sellers since it allows them to focus in just on the segment of the market

their specific configuration represents.

In San Francisco we also break

down sales by the ten real estate districts established by our local

association of realtors and MLS.

Sales by Price Range

Over the years we have added

reports that include all residential sales in specific price ranges. When we first started it was rather easy to

develop the ranges since it was obvious that selling prices under $500k were

quickly disappearing. The next ranges,

$500k-$799k and $800k-$999k, were chosen because many buyers were only able to

qualify for mortgages in those ranges.

(For a while, $799k represented the upper limit for buyers who could

only qualify for a “conforming” loan). The

final ranges were determined largely by what seem to be naturally occurring

sales price clusters or groups.

New Listing Market Watch

All of the reports described

above are done on a monthly or quarterly basis which means we’re looking back

at purchase decisions that were made as much as 4-8 weeks prior to the date of

the report. We were missing a “predictive”

component that would bring us closer to the current mindset of buyers and

sellers. We began to report on the “hot

sheet” feature of our MLS. This allows

us to track the number of new listings in the previous two weeks as well as

price reductions and the number of those new listings that go into contract

within that same period. This gives us

an idea of the volatility of the market since competition is almost always a

factor in the San Francisco real estate market.

Along with average asking prices for active listings which we track in

our monthly sales reports and personal knowledge gleaned from open houses,

brokers’ tours and other agents experiences, this information gets us as close

to current as possible.

Tuesday, February 2, 2016

Recap of 2015 San Francisco Residential Real Estate

The 2015 San Francisco real estate market continued its

steady march upward reaching new historic high selling prices almost every

month. In one sense San Francisco is the

“perfect storm” of residential real estate.

Inventory remains low, demand continues to be very strong, and

government regulation tends to limit the supply of new housing.

Below are some of the highlights we’ve found analyzing our

statistics and reporting during 2015:

1. Single family homes comprise about 44% of our residential market; condominiums (including TICs and co-ops) are 56% of the total.

2. For the second year in a row the total number of sales has decreased by about 7%. From 2008 to 2012 the number of sales had increased between 3 and 16%.

3. The percentage of single family homes and condos that sold below $1,000,000 has reached a new low of 38%. 62% sold for over $1,000,000.

4. Only 110 homes sold below $500,000, less than 10 per month. Most of these were either fixers or part of a “below market rate” program where selling and re-sale prices are mandated/regulated by legislation.

5. 2 bedroom/2 bath condominium units were the most sought after home in San Francisco followed by 1 bedroom/1 bath condo units, and then 2 bedroom/1 bath single family homes.

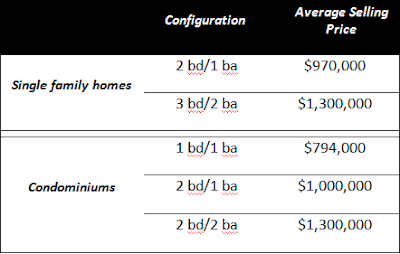

6. Average selling prices for the year are summarized below:

1. Single family homes comprise about 44% of our residential market; condominiums (including TICs and co-ops) are 56% of the total.

2. For the second year in a row the total number of sales has decreased by about 7%. From 2008 to 2012 the number of sales had increased between 3 and 16%.

3. The percentage of single family homes and condos that sold below $1,000,000 has reached a new low of 38%. 62% sold for over $1,000,000.

4. Only 110 homes sold below $500,000, less than 10 per month. Most of these were either fixers or part of a “below market rate” program where selling and re-sale prices are mandated/regulated by legislation.

5. 2 bedroom/2 bath condominium units were the most sought after home in San Francisco followed by 1 bedroom/1 bath condo units, and then 2 bedroom/1 bath single family homes.

6. Average selling prices for the year are summarized below:

8. The most active real estate districts in San Francisco for single family home sales in 2015 were:

9.

Subscribe to:

Posts (Atom)