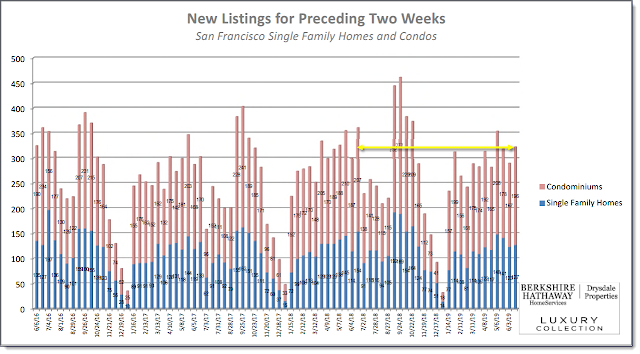

As expected the number of new listings in the last two weeks is at a low point for the year. There were only 46 new listings (24 single family homes and 22 condos). During the same two week period a year ago there were 32 new listings (14 single family homes and 18 condos).

As the chart above shows, this is an annual pattern and, if it holds, the next two weeks should see a major jump in new listings (which will include listings previously pulled off the market in advance of the holidays and then relisted in order to reset the number of days on market in the MLS).

What seems a bit unusual this year is the number of buyers still actively in the market. As shown in the following chart the percentage of new listings that went into contract.

Compared to last year at this time the percentage of single family homes that went into contract is up substantially -- 79% compared to 57% a year ago. For condos 41% went into contract compared to 50% for the same period last year.

Finally, the number of price reductions in the last two weeks is negligible with only 4 single family homes and 1 condo posting price reductions. That is essentially the same as last year.

The full report can be found on our web site:

Monday, December 30, 2019

Tuesday, December 3, 2019

New Listing Watch - post Thanksgiving

This graph tells all.

The number of new listings fell to it's lowest level of the year with a total of only 95 properties, 43 single family homes and 52 condos. During the same two week period last year the total number of new listings was 147. The difference is partly explained by the lateness of the Thanksgiving holiday weekend this year. Last year it was almost two weeks earlier.

The total number of new listings since the beginning of the year so far is 6,921. For the same period last year the total was 7,050.

The number of price reductions also fell in the last two weeks: 8 single family homes saw new price reductions along with 32 condos. That's more than a 50% reduction from the prior period. Compared to a year ago condos were virtually unchanged (32 vs 33) but there were fewer single family home price reductions (8 vs 18).

The number of new listings going into contract fell to 8 for single family homes compared to 18 in the prior period and compared to 8 a year ago. 6 condos went into contract compared to 13 in the prior period and only 2 a year ago.

Tuesday, November 5, 2019

New Listing Watch - sliding into the holiday season

Already we're being bombarded with reminders that the Thanksgiving and Christmas holiday season is fast approaching. You can also see that in our bi-weekly report.

This is a graph we don't show too often but it demonstrates the consistency of the San Francisco real estate market annual cycles. This shows five years of data and. Current year is solid dark red (single family homes) and solid green (condos). Six weeks ago we saw the peak of new listings right after the Labor Day holiday and as has been the case every year the number of new listings declines and will continue to decline until after New Year.

In the last two weeks the total number of new listings fell to 290 compared to 351 in the prior period. A year ago the number was virtually identical (289). The decline was most notable in single family homes which dropped 26% compared to the previous period (114 vs 154). Condos fell 11% (176 vs 197).

In both categories the number of new listings that went into contract in the last two weeks increased. Single family homes went from 15.8% compared to 14.3% in the prior period and compared to 10.5% a year ago. Condos increased to 13.1% compared to 11.2% in the prior period and compared to 10.9% a year ago.

The number of price reductions fell compared to the prior period. There were 23 single family homes price reductions compared to 41 in the prior period and compared to 33 a year ago. There were 70 condo price reductions compared to 95 in the prior period and compared to 58 a year ago.

The full report can be found at our web site: www.boldsf.com/Statistics

This is a graph we don't show too often but it demonstrates the consistency of the San Francisco real estate market annual cycles. This shows five years of data and. Current year is solid dark red (single family homes) and solid green (condos). Six weeks ago we saw the peak of new listings right after the Labor Day holiday and as has been the case every year the number of new listings declines and will continue to decline until after New Year.

In the last two weeks the total number of new listings fell to 290 compared to 351 in the prior period. A year ago the number was virtually identical (289). The decline was most notable in single family homes which dropped 26% compared to the previous period (114 vs 154). Condos fell 11% (176 vs 197).

In both categories the number of new listings that went into contract in the last two weeks increased. Single family homes went from 15.8% compared to 14.3% in the prior period and compared to 10.5% a year ago. Condos increased to 13.1% compared to 11.2% in the prior period and compared to 10.9% a year ago.

The number of price reductions fell compared to the prior period. There were 23 single family homes price reductions compared to 41 in the prior period and compared to 33 a year ago. There were 70 condo price reductions compared to 95 in the prior period and compared to 58 a year ago.

The full report can be found at our web site: www.boldsf.com/Statistics

Monday, October 21, 2019

New Listing Market Watch - price reductions up

New listings during the past two weeks declined compared to the prior period (351 vs 403) but all of that decline was in the condo sector (197 vs 264). The number of single family homes new listings increased (154 vs 139). We expect to see new listings decline steadily between now and the new year -- it happens every year.

The number of price reductions is up compared to the prior two week period -- 41 single family home price reductions vs 31 two weeks ago; 95 condo price reductions vs 73 two weeks ago. Compared to a year ago condo price reductions are up (95 vs 80) and single family home price reductions are down (41 vs 49).

The percentage of new listings that went into contract during the past two weeks ticked up compared to the prior period -- 14.3% vs 12.9% for single family homes and 11.2% vs 11.0% for condos. This is significantly higher than a year ago -- 14.3% vs 9.8% for single family homes and 11.2% vs 6.2% for condos.

After the usual initial increase of new inventory following Labor Day, the number of new listings usually begins to fall off through the remainder of the year. 2019 is following that same trend. Month over month new inventory has fallen by over 21% which is a bigger decline compared to last year which was only 3%. Combined single family homes and condos inventory is down 6%.

The number of price reductions is up compared to the prior two week period -- 41 single family home price reductions vs 31 two weeks ago; 95 condo price reductions vs 73 two weeks ago. Compared to a year ago condo price reductions are up (95 vs 80) and single family home price reductions are down (41 vs 49).

The percentage of new listings that went into contract during the past two weeks ticked up compared to the prior period -- 14.3% vs 12.9% for single family homes and 11.2% vs 11.0% for condos. This is significantly higher than a year ago -- 14.3% vs 9.8% for single family homes and 11.2% vs 6.2% for condos.

After the usual initial increase of new inventory following Labor Day, the number of new listings usually begins to fall off through the remainder of the year. 2019 is following that same trend. Month over month new inventory has fallen by over 21% which is a bigger decline compared to last year which was only 3%. Combined single family homes and condos inventory is down 6%.

Wednesday, October 16, 2019

At the Beginning the 4th quarter

The San Francisco real estate market remains strong, especially averages selling prices.

Average selling prices for the five configurations of homes we track (which make up approx 60% of all home sales) continue to be at historic highs with only one exception:

Year over year, the total number of sales fell by 6%; single family homes were down by 3% and condos were down by 7%.

As typical after Labor Day, inventory increased month over month by over 5% while single family homes were down by 10% but condos were up 15%. The largest inventory increase in our record keeping was back in 2010 when a total of 1,229 single family homes and condos were added to the market. This year that inventory increase was 665. During the intervening years the increases were in the 400s to 500s range.

Average selling prices for the five configurations of homes we track (which make up approx 60% of all home sales) continue to be at historic highs with only one exception:

*includes condos, co-ops and TICs

Year over year, the total number of sales fell by 6%; single family homes were down by 3% and condos were down by 7%.

As typical after Labor Day, inventory increased month over month by over 5% while single family homes were down by 10% but condos were up 15%. The largest inventory increase in our record keeping was back in 2010 when a total of 1,229 single family homes and condos were added to the market. This year that inventory increase was 665. During the intervening years the increases were in the 400s to 500s range.

Monday, October 7, 2019

New Listing Market Watch - past the peak

Following two two-week periods since Labor Day of increases in new listings, the number of new listings in the most recent two weeks is down (403 vs 505 in the previous period and vs 441 four weeks ago).

That's still more than we saw a year ago which posted 383 new listings. The difference is entirely in the condo category: 264 vs 229 a year ago. There were 10% fewer new listings of single family homes compared to a year ago: 139 vs 154.

The percentage of new listings that went into contract is up slightly compared to the previous period and compared to a year ago. For single family homes 12.9% went into contract vs 11.5% in the prior period and 9.7% a yea ago. For condos 11.0% vs 10.5% in the prior period and 5.2% a year ago.

Price reductions for single family homes was the same as the prior period and down compared to a year ago: 31 vs 31 in the prior period and vs 37 a year ago. For condos there were 73 price reductions compared to 51 in the prior period and 81 a year ago.

That's still more than we saw a year ago which posted 383 new listings. The difference is entirely in the condo category: 264 vs 229 a year ago. There were 10% fewer new listings of single family homes compared to a year ago: 139 vs 154.

The percentage of new listings that went into contract is up slightly compared to the previous period and compared to a year ago. For single family homes 12.9% went into contract vs 11.5% in the prior period and 9.7% a yea ago. For condos 11.0% vs 10.5% in the prior period and 5.2% a year ago.

Price reductions for single family homes was the same as the prior period and down compared to a year ago: 31 vs 31 in the prior period and vs 37 a year ago. For condos there were 73 price reductions compared to 51 in the prior period and 81 a year ago.

Monday, September 23, 2019

New Listing Market Watch -- Fall Surge, second installment

All you need to know is that everything is up 10-15% compared to a year ago, although it's a little more nuanced than that.

During the past two weeks there were 505 new listings of single family homes and condos compared to the same period last year -- up 10%. Compared to the prior period total new listings were up 15%. Most of this increase was in condos -- 313 vs 272 a year ago and vs 267 in the prior period.

Price reductions were also up compared to both the same period last year and the previous period this year. There were 31 price reductions of single family homes, 15% higher than the same period last year (27) and more than three times in the prior period (9). Condos saw 51 price reductions -- 11% higher than a year ago (46) and more than twice the number in the prior period (22).

As illustrated in the graphs above, if the typical cycle holds the number of new listings will start to drop by the time of our next report in two weeks. That decline will continue through the New Year's holiday.

The number of new listings that went into contract in the last two weeks was consistent with a year ago (11.5% vs 11.6% for single family homes and 10.5% vs 9.6% for condos).

During the past two weeks there were 505 new listings of single family homes and condos compared to the same period last year -- up 10%. Compared to the prior period total new listings were up 15%. Most of this increase was in condos -- 313 vs 272 a year ago and vs 267 in the prior period.

As illustrated in the graphs above, if the typical cycle holds the number of new listings will start to drop by the time of our next report in two weeks. That decline will continue through the New Year's holiday.

The number of new listings that went into contract in the last two weeks was consistent with a year ago (11.5% vs 11.6% for single family homes and 10.5% vs 9.6% for condos).

Tuesday, September 10, 2019

New Listing Market Watch - The Fall Surge

As predicted everywhere and every year new listings increase dramatically right after Labor day and this year is no exception.

Since the beginning of June we've averaged 249 new listings every two weeks. In the two weeks ending yesterday there were 441 new listings. It's easy to predict that two weeks from now we will see another surge in new listings. There were 174 new listings of single family homes compared to 85 in the prior period and compared to 192 a year ago. Similarly, there were 267 new listings of condos compared to 122 in the prior period and 252 a year ago.

There were only 9 price reductions of single family homes in the last two weeks compared to virtually the same number in the two prior periods each and compared to only 4 a year ago. The story is a little different for condo price reductions -- in the last two weeks there were 22 price reductions, a little higher than in each of the prior two periods, and compared to 34 a year ago.

As we've noted before, all of these new listings aren't "new new" listings. Some properties that had been on the market but not sold in June/July may have been taken off the market and then brought back on 30+ days later. That resets the "days on market" clock to zero days on market.

Since the beginning of June we've averaged 249 new listings every two weeks. In the two weeks ending yesterday there were 441 new listings. It's easy to predict that two weeks from now we will see another surge in new listings. There were 174 new listings of single family homes compared to 85 in the prior period and compared to 192 a year ago. Similarly, there were 267 new listings of condos compared to 122 in the prior period and 252 a year ago.

There were only 9 price reductions of single family homes in the last two weeks compared to virtually the same number in the two prior periods each and compared to only 4 a year ago. The story is a little different for condo price reductions -- in the last two weeks there were 22 price reductions, a little higher than in each of the prior two periods, and compared to 34 a year ago.

As we've noted before, all of these new listings aren't "new new" listings. Some properties that had been on the market but not sold in June/July may have been taken off the market and then brought back on 30+ days later. That resets the "days on market" clock to zero days on market.

Friday, August 23, 2019

Monday, August 19, 2019

Break Ins

The California Association of Realtors publishes some interesting statistics from time to time.

Friday, August 16, 2019

New Listing Market Watch - winding down summer

We continue to follow the well-established summer pattern of low inventory in the July/August summer months. In the last two weeks only 208 new listings came on the market -- the lowest number since the Christmas/New Year holiday period. A year ago it was an almost identical 209 new listings for the same period.

In our report that will be posted on September 9th (a week after Labor Day) we expect to see the usual jump in new listings. What seems a little different this year is that demand is stronger than last year for single family homes which shows up in the days-on-market figures which are slightly down this year compared to last. For July average DOM for single family homes was 21 compared to 23 the year before.

The number of price reductions is down significantly compared to a year ago. Single family homes saw only 9 price reductions in the last two weeks compared to 13 in the same period last year. SImilarly price reductions for condos was 17 this year vs 20 last year.

In our report that will be posted on September 9th (a week after Labor Day) we expect to see the usual jump in new listings. What seems a little different this year is that demand is stronger than last year for single family homes which shows up in the days-on-market figures which are slightly down this year compared to last. For July average DOM for single family homes was 21 compared to 23 the year before.

The number of price reductions is down significantly compared to a year ago. Single family homes saw only 9 price reductions in the last two weeks compared to 13 in the same period last year. SImilarly price reductions for condos was 17 this year vs 20 last year.

End of Summer State of the Market

Summer usually has some of lowest inventory levels of the

year and 2019 is no exception. New listings of single family homes were

down slightly but the number of condos/TICs were up slightly compared to a year

ago.

Single Family Homes:

Average selling prices for single family homes continue to

be a historic highs. In July, the average days on market (DOM) for

2bed/1bath and 3/2 single family homes were 17 and 22 respectively and premiums

(selling price divided by listing price) were 118% and 122% respectively.

As of 8/13/19 thee is a 2-week supply of 2/1 and a 3-week

supply of 3/2 single family homes.

Condos:

Condos, like single family homes, are also selling at

historic high prices. The three configurations we track (1/1, 2/1 and

2/2) average selling prices in July were $865k, $1,201K and $1,449k

respectively.

DOM were 36 days, 21 days and 36 days. Premiums were

111%, 117% and 104%.

Inventory is more plentiful: 1/1 inventory is 6 weeks,

2/1 inventory is 4 weeks and 2/2 inventory is 8 weeks.

Our reports can be found at www.boldsf.com/Statistics

Tuesday, July 30, 2019

New Listing Market Watch -- price reductions

As is typical this time of year the total number of new listings (single family homes, condos/tics/co-ops) in the last two weeks declined and are at lower levels than a year ago by about 2%.

New listings of single family homes are down by 21 (18%); condos actually had 15 more new listings than last year at this time (12%).

The number of new listings that went into contract over the past two weeks has increased compared to the previous period and compared to a year ago. There were 17 single family homes (17.9%) and 21 condos (14.7%).

The number of price reductions of single family homes is up compared to the prior period and compared to a year ago (20 vs 17 in the prior period and 16 a year ago). There were 25 price reductions of condos compared to the prior period of 28 and 16 a year ago.

With this light inventory we have compiled a list of single family homes and condos where the asking price has been reduced within the last 14 days.

View Listings

View Listings link will be available for 30 days. If you do not see a link, copy this text to the address line in your browser:

https://sfarmls.rapmls.com/scripts/mgrqispi.dll?APPNAME=Sanfrancisco&PRGNAME=MLSLogin&ARGUMENT=Ok7KmNi58nbInAxeCH8GTQH%2BL4sE6jNYVnrYtobmDVE%3D&KeyRid=1&Include_Search_Criteria=on&CurrentSID=167140966&MLS_Origin=SFAR&Report_Code_String=10005&SID=&Report_Format=HTML&Type_Of_Search=&Search_Type=HS

New listings of single family homes are down by 21 (18%); condos actually had 15 more new listings than last year at this time (12%).

The number of new listings that went into contract over the past two weeks has increased compared to the previous period and compared to a year ago. There were 17 single family homes (17.9%) and 21 condos (14.7%).

The number of price reductions of single family homes is up compared to the prior period and compared to a year ago (20 vs 17 in the prior period and 16 a year ago). There were 25 price reductions of condos compared to the prior period of 28 and 16 a year ago.

With this light inventory we have compiled a list of single family homes and condos where the asking price has been reduced within the last 14 days.

View Listings

View Listings link will be available for 30 days. If you do not see a link, copy this text to the address line in your browser:

https://sfarmls.rapmls.com/scripts/mgrqispi.dll?APPNAME=Sanfrancisco&PRGNAME=MLSLogin&ARGUMENT=Ok7KmNi58nbInAxeCH8GTQH%2BL4sE6jNYVnrYtobmDVE%3D&KeyRid=1&Include_Search_Criteria=on&CurrentSID=167140966&MLS_Origin=SFAR&Report_Code_String=10005&SID=&Report_Format=HTML&Type_Of_Search=&Search_Type=HS

Sunday, July 28, 2019

WRONG: "Bay Area home sales fell sharply in June — prices mostly fell, too"

It's been widely reported that the number of home sales in the Bay area "fell sharply" in June and "prices mostly fell too". That's from a headline in the Chronicle. Just this week there was a similar story in the Mercury News.

The Mercury News story omits San Francisco data and only covers Santa Clara, Alameda, Contra Costa and San Mateo counties. The Chronicle story covers all nine Bay area counties.

My comments here relate to the Chronicle story. First, the Chronicle's own graphic shows median prices are up month over month (June compared to May) in seven of the nine counties. On a year over year comparison five of the nine counties show an increase in medial sales prices and two counties show no change. How does this support the idea that "prices mostly fell too"? It obviously doesn't.

It's true that if you average the median sales price of all nine counties there is a slight decline on a month over month basis but that attributable entirely to one county (San Mateo). And the idea of averaging selling prices over such a wide geographic area is not very useful if you're trying to get a sense of the market.

Or look at it this way: in June 6124 homes were sold in counties where the median sales price was up from the previous month. Only 1233 were sold in the two counties that showed a decline in median sales price. Again, how does that support the idea that "prices mostly fell"?

Specifically for San Francisco, it's true that the number of sales in June declined compared to May -- but that's been true seven out of the last thirteen years. If you look at the month-by-month sales profile in San Francisco, June is the beginning of the summer doldrums that lasts until Labor day. This is a repeating pattern that has been true through boom and bust economies.

The following graphic shows total sales for the first and second half of each year. The first half of 2019 is well within the normal range of sales.

Hysterical headlines notwithstanding, for the five categories of condos and single family homes that we track on a monthly basis the average sales price for four out of five of those categories are at all all time highs.

The Mercury News story omits San Francisco data and only covers Santa Clara, Alameda, Contra Costa and San Mateo counties. The Chronicle story covers all nine Bay area counties.

My comments here relate to the Chronicle story. First, the Chronicle's own graphic shows median prices are up month over month (June compared to May) in seven of the nine counties. On a year over year comparison five of the nine counties show an increase in medial sales prices and two counties show no change. How does this support the idea that "prices mostly fell too"? It obviously doesn't.

It's true that if you average the median sales price of all nine counties there is a slight decline on a month over month basis but that attributable entirely to one county (San Mateo). And the idea of averaging selling prices over such a wide geographic area is not very useful if you're trying to get a sense of the market.

Or look at it this way: in June 6124 homes were sold in counties where the median sales price was up from the previous month. Only 1233 were sold in the two counties that showed a decline in median sales price. Again, how does that support the idea that "prices mostly fell"?

Specifically for San Francisco, it's true that the number of sales in June declined compared to May -- but that's been true seven out of the last thirteen years. If you look at the month-by-month sales profile in San Francisco, June is the beginning of the summer doldrums that lasts until Labor day. This is a repeating pattern that has been true through boom and bust economies.

The following graphic shows total sales for the first and second half of each year. The first half of 2019 is well within the normal range of sales.

Hysterical headlines notwithstanding, for the five categories of condos and single family homes that we track on a monthly basis the average sales price for four out of five of those categories are at all all time highs.

Tuesday, July 16, 2019

New Listing Market Watch - mid July doldrums?

No. While it may be true that the number of new listings tends to slow down between Independence Day and Labor Day there is still plenty of activity. In the last two weeks 241 new residential listings came on the market compared to 257 in the same period in 2018. That's down 6%. You can see the breakdown between single family homes and condos here:

20 of those new listings went into contract.

The number of price reductions is increasing: 17 single family homes and 28 condos. For the same period last year the figures were 15 and 23.

These statistics represent opportunities for buyers but perhaps not quite as fierce as peak times (spring and early fall).

And if all of this leaves you uneasy, contemplate the garden for a while.

20 of those new listings went into contract.

The number of price reductions is increasing: 17 single family homes and 28 condos. For the same period last year the figures were 15 and 23.

These statistics represent opportunities for buyers but perhaps not quite as fierce as peak times (spring and early fall).

And if all of this leaves you uneasy, contemplate the garden for a while.

Wednesday, July 10, 2019

Our Little Corner of the World IS Different

Intuitively, true San Franciscans know this is true. We're different; we're unique ...

I found an example in one of the social media items they put out from time-to-time that they encourage agents to use.

When I first saw this I said to myself "this doesn't seem to fit our market in San Francisco." Myself replied: "prove it."

OK, here it is. Looking at single family home sales in district 2 (the Sunset) since 1/11/2019 there were a total of 174 closed transactions:

The average selling price for the 30 owner occupied properties was $1.476 million (19 DOM).

The average selling price for the 8 tenant occupied properties was $1.294 million.(38 DOM).

The average selling price for the 136 vacant properties was $1.695 million (20 DOM).

So for this sample, "vacant" is the clear winner with highest average sales price and virtual tie for the shortest days on market.

I found an example in one of the social media items they put out from time-to-time that they encourage agents to use.

When I first saw this I said to myself "this doesn't seem to fit our market in San Francisco." Myself replied: "prove it."

OK, here it is. Looking at single family home sales in district 2 (the Sunset) since 1/11/2019 there were a total of 174 closed transactions:

The average selling price for the 30 owner occupied properties was $1.476 million (19 DOM).

The average selling price for the 8 tenant occupied properties was $1.294 million.(38 DOM).

The average selling price for the 136 vacant properties was $1.695 million (20 DOM).

So for this sample, "vacant" is the clear winner with highest average sales price and virtual tie for the shortest days on market.

Friday, July 5, 2019

Comparison of US and International Housing Trends

This is Bill Jansen's Facebook post quoting from an Economist article that says "investing in housing is safe with no housing bubble in site".

Tuesday, July 2, 2019

New Listing Market Watch - Summer Starts

Summer may have begun officially on June 21st but in San Francisco real estate the summer season usually starts just before the 4th of July holiday. The number of new listings declines significantly and the number of price reductions increases temporarily. This year follows that trend.

During the last two weeks (the last half of June) the number of new listings dropped to 236 compared to 323 in the prior period (the first half of June). The bulk of the reduction was in condos (128 vs 196 in the previous period). New listings of single family homes fell to 108 vs 127 in the prior period.

The number of price reductions was almost the same as the prior two weeks (20 vs 16 reductions in single family homes and 32 vs 43 in condos). This year the significant increase in price reductions happened in the first half of June.

Te number of new listings that went into contract stayed just about the same as the previous period: 20 single family homes vs 21 two weeks earlier and 32 condos vs 34 in the prior period.

The full report is posted on our web site:

www.boldsf.com/Statistics

During the last two weeks (the last half of June) the number of new listings dropped to 236 compared to 323 in the prior period (the first half of June). The bulk of the reduction was in condos (128 vs 196 in the previous period). New listings of single family homes fell to 108 vs 127 in the prior period.

The number of price reductions was almost the same as the prior two weeks (20 vs 16 reductions in single family homes and 32 vs 43 in condos). This year the significant increase in price reductions happened in the first half of June.

Te number of new listings that went into contract stayed just about the same as the previous period: 20 single family homes vs 21 two weeks earlier and 32 condos vs 34 in the prior period.

The full report is posted on our web site:

www.boldsf.com/Statistics

Wednesday, June 19, 2019

Hot Weather | Hot Market

Our real estate market is as hot as it has ever been. Our most recent two week New Listing Report shows an 11% decline in new inventory coming on the market compared to the same two week period in 2018. There were 18% fewer single family homes coming on the market during the past two weeks compared to a year ago and condos were down 5%. Yet June sales through the 17th have been remarkable even by San Francisco standards. As we reviewed the June sales data a few items stand out.

Average selling prices continue to be at or close to historic highs. Days-on-market are amazingly short and the premiums paid are shocking. Here are results for single family homes:

Condo average selling prices continue to set historic highs also. Their DOM and premiums paid also reflect a very strong demand.

If the market follows recent trends new inventory will decline in number until Labor Day. Listings are gold in the coming months. Many buyers will find it a tough market to navigate and win in the face of competition which is sometimes fierce. And as usual cash remains king.

We also note that total residential sales are down approx. 5% (116 homes) compared to this time in 2018.

Average selling prices continue to be at or close to historic highs. Days-on-market are amazingly short and the premiums paid are shocking. Here are results for single family homes:

Condo average selling prices continue to set historic highs also. Their DOM and premiums paid also reflect a very strong demand.

If the market follows recent trends new inventory will decline in number until Labor Day. Listings are gold in the coming months. Many buyers will find it a tough market to navigate and win in the face of competition which is sometimes fierce. And as usual cash remains king.

We also note that total residential sales are down approx. 5% (116 homes) compared to this time in 2018.

Monday, June 17, 2019

New Listing Watch - summer solstice report

For the past two years we've seen an uptick in new listings during this middle week of June, apparently to get properties on the market before the Independence Day holiday. That's true again this year but mostly for condos. In the past two weeks there were 196 new condo listings compared to 167 during the previous two-week period. Single family homes saw only 127 new listings compared to 123 during the previous period.

Compared to a year ago the total number of new listings for the last two weeks was down: 323 vs 361.

Assuming the usual annual trend continues we should see a significant drop off of new listings until Labor Day.

The percentage of single family homes new listings that went into contract in the same two week period has held fairly steady since mid March -- 16.5%. For condos it was 17.3% and has been steady since early May.

Price reductions have jumped up compared to the prior period: 16 single family homes saw price reductions vs only 6 in the prior period and 43 condos vs 22 in the prior period.

For the full report, see our web site http://www.boldsf.com/Statistics%20test/Statistics.html

Compared to a year ago the total number of new listings for the last two weeks was down: 323 vs 361.

Assuming the usual annual trend continues we should see a significant drop off of new listings until Labor Day.

The percentage of single family homes new listings that went into contract in the same two week period has held fairly steady since mid March -- 16.5%. For condos it was 17.3% and has been steady since early May.

Price reductions have jumped up compared to the prior period: 16 single family homes saw price reductions vs only 6 in the prior period and 43 condos vs 22 in the prior period.

For the full report, see our web site http://www.boldsf.com/Statistics%20test/Statistics.html

Monday, May 20, 2019

New Listing Watch -- pre Memorial Day

There were 319 new listings during the past two weeks which is fewer by 10% compared to the previous two week period and also compared to the same period a year ago. Most of the fall off is in the condo market where new listings dropped from 206 in the prior period to 178.

14% of new single family homes listings and 18% of new condo listings went into contract within the same two week period. That's down a few points for single family homes compared to the previous period and compared to the same period last year. It's also down for condos compared to the prior period but higher by almost 4% compared to a year ago.

Price reductions were up compared to the prior period for both single family homes (12 vs 7) and condos (25 vs 4). But price reductions are down compared to a year ago.

The full report can be found at our web site: www.boldsf.com

14% of new single family homes listings and 18% of new condo listings went into contract within the same two week period. That's down a few points for single family homes compared to the previous period and compared to the same period last year. It's also down for condos compared to the prior period but higher by almost 4% compared to a year ago.

Price reductions were up compared to the prior period for both single family homes (12 vs 7) and condos (25 vs 4). But price reductions are down compared to a year ago.

The full report can be found at our web site: www.boldsf.com

Trump and the National Association of Realtors

Invited to address the NAR at its (annual?) meeting last week in Washington, the New York Times reports:

By the time the president took the stage before the National Association of Realtors in Washington on Friday, he was in a feisty mood.

He recalled that a consultant tried to make work for himself by identifying environmental concerns on a property Mr. Trump wanted to develop. “I fired his ass so fast,” the president recalled.

He told the Realtors that he used to refuse to pay brokers their traditional 6 percent commission and instead gave them just 1 percent.

“I was famous for that,” he said. When they booed, he quickly retreated. “Don’t worry. Nobody accepted it. But I tried like hell.”

Then he went after one of his favorite targets — journalists — claiming that recent reports of infighting within his national security team were made up. “There is no source,” he said. “The person doesn’t exist. The person’s not alive. It’s bullshit, O.K.? It’s bullshit.”

And with that, the television networks had to hit their bleeper again.This is disappoint (but not surprising) to hear the President of our country behave this way. (Click on the link above for the full story).

Thursday, May 9, 2019

What not to do when selling your home

We see articles like this with similar headlines all the time but this recent article in the Washington Post hits most of the important points:

Letting ego or emotion affect the sale

Overlooking extra fees at closing

Not staging a home

Putting bad photos of your house online

Trying to sell the house yourself

Pricing your home too high

Failing to make necessary repairs

Failing to disclose a defect

Click here for the full article.

Letting ego or emotion affect the sale

Overlooking extra fees at closing

Not staging a home

Putting bad photos of your house online

Trying to sell the house yourself

Pricing your home too high

Failing to make necessary repairs

Failing to disclose a defect

Click here for the full article.

Monday, April 22, 2019

New Listing Watch -- fewer listings, faster sales

New listings in the last 14 days are down about 10% compared to the previous period and compared to the same period last year. Most of the reduction is in condos (165 new listings compared to 192 two weeks ago and compared to 189 a year ago).

The number of new single family listings that went into contract in the same two week period has increased strongly compared to the prior period (18.8% vs 13.9%). The increase for condos was modest at 24.8% vs 23.4%.

The number of price reductions is down compared to the previous period (8 vs 11 for single family homes and 20 vs 27 for condos) and compared to a year ago (8 vs 13 for single family homes and 20 vs 29 for condos).

At the beginning of April the total number of active residential listings in the five categories we track* in San Francisco was 338 which is up about 11% compared to the same time last year but down compared to 2017 and 2016.

The full report can be found on our web site:

http://www.boldsf.com/Statistics%20test/Statistics.html

*Every month we survey sales and active inventory for five categories of condos and single family homes in San Francisco. Those five categories comprise approximately 51% of residential sales in San Francisco. The categories are: 2 bed/1 bath single family, 3 bed/2 bath single family, 1 bed/1 bath condo, 2 bed/1 bath condo and 2 bed/2 bath condo.

The number of new single family listings that went into contract in the same two week period has increased strongly compared to the prior period (18.8% vs 13.9%). The increase for condos was modest at 24.8% vs 23.4%.

The number of price reductions is down compared to the previous period (8 vs 11 for single family homes and 20 vs 27 for condos) and compared to a year ago (8 vs 13 for single family homes and 20 vs 29 for condos).

At the beginning of April the total number of active residential listings in the five categories we track* in San Francisco was 338 which is up about 11% compared to the same time last year but down compared to 2017 and 2016.

The full report can be found on our web site:

http://www.boldsf.com/Statistics%20test/Statistics.html

*Every month we survey sales and active inventory for five categories of condos and single family homes in San Francisco. Those five categories comprise approximately 51% of residential sales in San Francisco. The categories are: 2 bed/1 bath single family, 3 bed/2 bath single family, 1 bed/1 bath condo, 2 bed/1 bath condo and 2 bed/2 bath condo.

Subscribe to:

Posts (Atom)