Our regular reports have been updated to include December sales results. During our office meeting today we discussed some of the highlights. Here are my notes:

”Existing home sales hit its

lowest level last year since 1995, according to a report from the National Association of

Realtors”

San Francisco’s version of this quote: existing home sales were the lowest we’ve had

going back as far as my records go – 2005.

Total residential (not residential income, multi-unit) sales were 3,858. The previous low was in 2008 when 4,334 units

sold.

Residential income property sales (2, 3, and 4-units) 474 – the lowest

in 10 years except for 2020 which was 444.

On average 638 residential income properties sell. The same profile shows up in the 5+ unit

category. 110 sales in 2023, the lowest

except for 2020 when sales were 93.

I also consulted ChatGPT which told me:

“I don't have real-time data or

updates for the year 2023. For the most accurate and recent information on the

residential real estate market in San Francisco in 2023, I recommend checking

reliable sources such as real estate reports, market analyses, or news articles

from that time. Market conditions can change rapidly, and up-to-date

information will provide a more accurate picture of the trends, pricing, and

overall dynamics in the San Francisco real estate market during the specific

period you're interested in.”

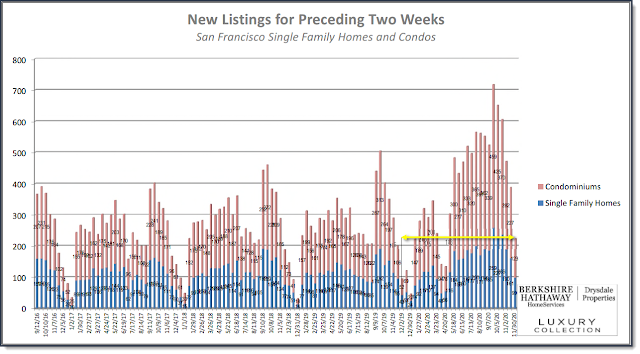

The graph above shows new listings in two week increments going back to 2017.

· There was a big jump in new condo listings in the last two

weeks which we expect each year immediately following the holidays (rain, shine, recession or pandemic). 264 compared to 83 in the prior two week

period. 265 for the same period last

year and compared to 147 in 2020 (pre pandemic).

· Single family homes increase was not quite as dramatic. 127 new listings compared 43 in the prior two

week period. 99 a year ago and compared

to 74 in 2020 (pre pandemic).

·

The number of price reductions are about the

same as last year – 16 for single family homes and 38 for condos. Pre pandemic price reductions were 5 and 12.

The number of active listings (especially condos) exceeded monthly

sales in every month in 2023 in a much wider gap between listings and sales than pre-pandemic.

· Basically, there are plenty of listings but not enough

buyers.

·

These two graphs tell the story.

We survey five different configurations of single family homes and condos.

o

2 bed, 1 bath single family homes sales prices have gone

down 12% from their high in 2021 of $1,339 to $1,180 in 2023 a number not seen

since 2017.

o

3/2 single family homes have also gone down 12%

in just one year from their high in 2022 of $1,773 down to $1,553 (back to 2018

levels).

o

1/1 condos average selling price in 2023 was

$708, down 19% compared to their high of $871 in 2019. Annual average selling prices have gone down

each of the past four years.

o

2/1 condos are down 14% from $1,174 high in 2019

to $1,011 in 2023.

o

2/2 condos are down 12% from $1,463 in 2019 to

$1,293 in 2023.

· Similar reductions in average selling prices for multi-unit

properties.

· Similar reductions in average selling prices for multi-unit

properties.

o

2-units down 12% from their high in 2021 ($1,962

vs $2,221)

o

3-units down 15% from their high in 2018 ($1,996

vs $2,328)

o

4-units down 13% from their high in 2021 ($1,882

vs $2,159)

·

Currently, there are 400+ active listings with price

differentials between TICs and similarly configured condos ranging between $48k

for 1 bedroom units to $300k+ for 2bd/2ba units.

Those differentials hold for average sales

prices with the range being $18k for 1bd, $220k for 2bd/1ba, and $209k for

2bd/2ba.