This week we posted our regular monthly and quarterly reports for 2022 as well as our biweekly New Listing Market Watch report. Here are some highlights (lowlights?).

- · Single family new listings: 94 in 2021, 64 in 2022, 42 this year.

- · Condo new listings: 241, 151, and 84

- · Sales in December down compared to

November (typical for this time of year)

- · Average selling prices are down

compared to November, -2% for single family homes and 22% for condos. Compared to December a year ago average

selling prices are down 22% for single family homes and 24% for condos.

- · Inventory is up over 50% for single

family homes compared to a year ago, and 7-8% for condos.

- · Premiums for the year compared to

2021 were steady at 112% for single family homes and 103% for condos.

- · BUT, for the last six months premiums

dropped for single family homes to 105% and for condos to 100%. (By comparison for the last half of 2021

premiums were 112% for single family homes and 105% for condos).

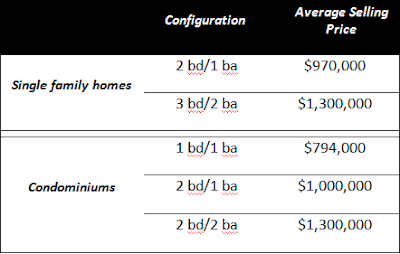

- · For the five configurations of single

family homes and condos we track, the number of sales and average sales prices were

down across the board.