Another two weeks and more of the same. New listings during the last two weeks matched closely with the same period a year ago -- 276 new listings last year and 307 this year, an increase of about 11%.

Virtually all of the increase came in the form of condos. Last year there were 159 new condo listings; this year there were 186.

After four weeks of relatively slow sales of single family homes, in this latest two week period almost 12% of them went into contract during the same period. The rate of sales on condos remained steady at 14.5% which is similar to the rate for the last six weeks.

Monday, February 29, 2016

Monday, February 15, 2016

New Listing Market Watch - Signs of a cooling market?

New listings for the past two weeks continue in virtual lockstep with the same period a year ago. New listings of single family homes were down 8% compared to last year (108 vs. 117). New listings for condos was up by 1 from 146 a year ago vs. 147 during the last two weeks this year.

The real difference this year seems to be a much lower percentage of listings going into contract within the first two weeks. For the period ending 2/15/16 only 4.6% of new single family homes listing went into contract within that same two week period compared to over 17% for the same period last year. Similarly with condos, only 14% vs. 22% last year.

Is the market cooling?

Is the market cooling?

Thursday, February 11, 2016

"Lies, damned lies, and statistics"

That line often used by Mark Twain came to mind as I was looking at the web site of one of the more prominent brokers in town today. In it they have a section called Market Conditions where they break down certain residential real estate statistics by MLS district and subdistrict.

Just like almost everyone I know, I always look at my neighborhood.

It shows 30 properties "for sale right now" and an average days on market of 96.

Here's what our MLS says:

It's a little hard to read -- you can click on it to enlarge. It says there are a total of 12 properties for sale (1 single family home and 11 condos/TICs). Average days on market is 30 for the condos and 3 for the single family home.

Their "average days on market", or DOM, is way off the mark at 96. If that number refers to the currently active listings, the MLS says the average days on market is 30. If it refers to previous sales, the average DOM for sales during the two month period 11/15/15 through 1/15/16 is 44.

Sometimes "active" listings are calculated to include those already in contract but with contingencies. Even if you include those properties, the number of active listings on Potrero Hill is only 21. But, for all practical purposes those additional 9 properties are not available for purchase.

We spend a lot of time surveying and reporting sales numbers for the San Francisco residential real estate market and there are a lot of other sources that report mostly sales data. As this example shows, it's easy to get confused over apparently conflicting reports. What's often missing is context.

Reports should always explain exactly where (and when) the data comes from and what it includes. In the case of this broker, their "active" data is four or five days old. Our reports also try to compare apples to apples. Reporting a general "average" sales price by lumping together condos and single family homes, studios and mansions, doesn't serve any real purpose since no buyer is looking for an average house. Buyers are looking for specific configurations so knowing the average sales price that includes everything isn't terribly useful. Similarly for the seller of, for example, a three bedroom single family home, a general average doesn't provide much guidance in setting their asking price.

Just like almost everyone I know, I always look at my neighborhood.

Here's what our MLS says:

Their "average days on market", or DOM, is way off the mark at 96. If that number refers to the currently active listings, the MLS says the average days on market is 30. If it refers to previous sales, the average DOM for sales during the two month period 11/15/15 through 1/15/16 is 44.

Sometimes "active" listings are calculated to include those already in contract but with contingencies. Even if you include those properties, the number of active listings on Potrero Hill is only 21. But, for all practical purposes those additional 9 properties are not available for purchase.

We spend a lot of time surveying and reporting sales numbers for the San Francisco residential real estate market and there are a lot of other sources that report mostly sales data. As this example shows, it's easy to get confused over apparently conflicting reports. What's often missing is context.

Reports should always explain exactly where (and when) the data comes from and what it includes. In the case of this broker, their "active" data is four or five days old. Our reports also try to compare apples to apples. Reporting a general "average" sales price by lumping together condos and single family homes, studios and mansions, doesn't serve any real purpose since no buyer is looking for an average house. Buyers are looking for specific configurations so knowing the average sales price that includes everything isn't terribly useful. Similarly for the seller of, for example, a three bedroom single family home, a general average doesn't provide much guidance in setting their asking price.

Wednesday, February 3, 2016

Report Methodology

From time to time we get questions about the methodology behind the reports we publish. Here's a little background:

Over the years as our clients

became more tech-smart and sophisticated, our data collection has also

evolved.

Monthly Sales Reports

Today, we conduct a monthly

survey of San Francisco and Marin counties residential real estate markets looking at sales and current listings. In San Francisco our survey covers

approximately 61% of all residential sales (single family homes, condos, co-ops

and TICs plus 100% of 2-4 unit residential buildings). In

Marin we survey approximately 75% of all residential sales (single family homes and condos.

One of the features that sets

our surveys apart from most published statistics is that we focus on the

most common/popular configurations of homes (for example: 2 bedroom, 1 bath

single family homes; 1 bedroom, 1 bath condos).

This gives a truer picture of changes in the market than averages that

include all residential properties, especially since we have some very

expensive homes in both counties that would otherwise skew results. It’s especially helpful for buyers and

sellers since it allows them to focus in just on the segment of the market

their specific configuration represents.

In San Francisco we also break

down sales by the ten real estate districts established by our local

association of realtors and MLS.

Sales by Price Range

Over the years we have added

reports that include all residential sales in specific price ranges. When we first started it was rather easy to

develop the ranges since it was obvious that selling prices under $500k were

quickly disappearing. The next ranges,

$500k-$799k and $800k-$999k, were chosen because many buyers were only able to

qualify for mortgages in those ranges.

(For a while, $799k represented the upper limit for buyers who could

only qualify for a “conforming” loan). The

final ranges were determined largely by what seem to be naturally occurring

sales price clusters or groups.

New Listing Market Watch

All of the reports described

above are done on a monthly or quarterly basis which means we’re looking back

at purchase decisions that were made as much as 4-8 weeks prior to the date of

the report. We were missing a “predictive”

component that would bring us closer to the current mindset of buyers and

sellers. We began to report on the “hot

sheet” feature of our MLS. This allows

us to track the number of new listings in the previous two weeks as well as

price reductions and the number of those new listings that go into contract

within that same period. This gives us

an idea of the volatility of the market since competition is almost always a

factor in the San Francisco real estate market.

Along with average asking prices for active listings which we track in

our monthly sales reports and personal knowledge gleaned from open houses,

brokers’ tours and other agents experiences, this information gets us as close

to current as possible.

New Listing Watch - in Lockstep with Last Year

Our second look so far at the number of new residential listings in San Francisco for 2016 shows an almost lockstep similarity with the same period last year.

There were 84 new single family homes and 134 condos newly listed in the two week period ending 2/1/2016. An almost identical number and ratio was listed in the same period last year: 18 single family homes and 130 condos. The only meaningful difference this year is that only 6% of the single family homes went into contract during that same two week period vs. 21% last year. Similarly with condos, 18 went into contract this year compared to 38 last year.

This could mean a slowing in demand (and competition). The number of newly listed properties going into contract in the same two week period as they were listed has been less than the comparable period a year ago for the last 15 reporting periods except for 4 (3 for condos).

There were 84 new single family homes and 134 condos newly listed in the two week period ending 2/1/2016. An almost identical number and ratio was listed in the same period last year: 18 single family homes and 130 condos. The only meaningful difference this year is that only 6% of the single family homes went into contract during that same two week period vs. 21% last year. Similarly with condos, 18 went into contract this year compared to 38 last year.

This could mean a slowing in demand (and competition). The number of newly listed properties going into contract in the same two week period as they were listed has been less than the comparable period a year ago for the last 15 reporting periods except for 4 (3 for condos).

Tuesday, February 2, 2016

Recap of 2015 San Francisco Residential Real Estate

The 2015 San Francisco real estate market continued its

steady march upward reaching new historic high selling prices almost every

month. In one sense San Francisco is the

“perfect storm” of residential real estate.

Inventory remains low, demand continues to be very strong, and

government regulation tends to limit the supply of new housing.

Below are some of the highlights we’ve found analyzing our

statistics and reporting during 2015:

1. Single family homes comprise about 44% of our residential market; condominiums (including TICs and co-ops) are 56% of the total.

2. For the second year in a row the total number of sales has decreased by about 7%. From 2008 to 2012 the number of sales had increased between 3 and 16%.

3. The percentage of single family homes and condos that sold below $1,000,000 has reached a new low of 38%. 62% sold for over $1,000,000.

4. Only 110 homes sold below $500,000, less than 10 per month. Most of these were either fixers or part of a “below market rate” program where selling and re-sale prices are mandated/regulated by legislation.

5. 2 bedroom/2 bath condominium units were the most sought after home in San Francisco followed by 1 bedroom/1 bath condo units, and then 2 bedroom/1 bath single family homes.

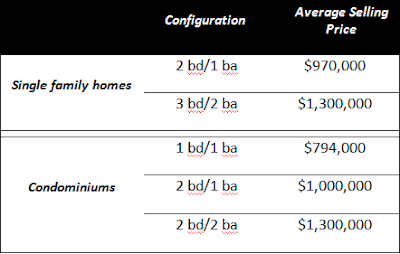

6. Average selling prices for the year are summarized below:

1. Single family homes comprise about 44% of our residential market; condominiums (including TICs and co-ops) are 56% of the total.

2. For the second year in a row the total number of sales has decreased by about 7%. From 2008 to 2012 the number of sales had increased between 3 and 16%.

3. The percentage of single family homes and condos that sold below $1,000,000 has reached a new low of 38%. 62% sold for over $1,000,000.

4. Only 110 homes sold below $500,000, less than 10 per month. Most of these were either fixers or part of a “below market rate” program where selling and re-sale prices are mandated/regulated by legislation.

5. 2 bedroom/2 bath condominium units were the most sought after home in San Francisco followed by 1 bedroom/1 bath condo units, and then 2 bedroom/1 bath single family homes.

6. Average selling prices for the year are summarized below:

8. The most active real estate districts in San Francisco for single family home sales in 2015 were:

9.

Subscribe to:

Posts (Atom)