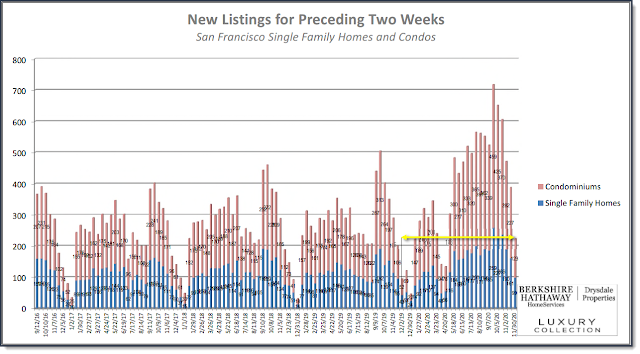

The San Francisco residential real estate market continues with an ever increasing number of new listings. John and I have been tracking these "hot sheet" data every two weeks for at least the last seven years and the last 14 day period, June 15 thru June 29, has the highest number of new listings that we've seen. Year over year during the same 14 day period total inventory was 236 last year and 520 this year, a 220% increase. Compared to the prior two week period there was an 11% increase.

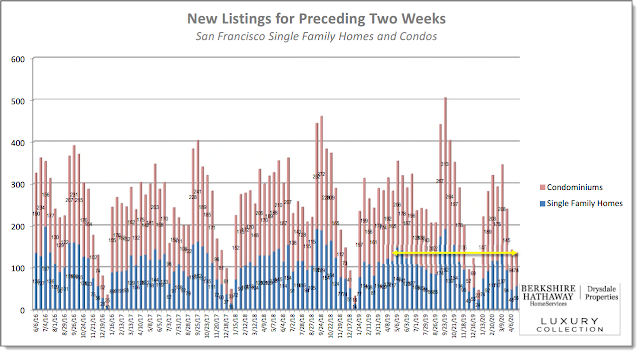

The San Francisco market has become a rather unique community as 70% of residential properties are condos/TICs and only 30% are single family homes. With limited available land the percentage of condos/TICs will continue to grow with single family homes becoming an even scarcer commodity.

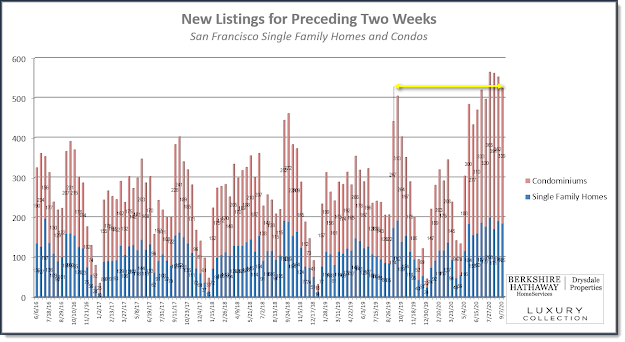

While the total number of new listings have been record breaking the distribution between single family homes and condos/TICs is well worth noting. 64% of the listings were condos/TICs with single family homes accounting for the other 36%.

The single family home market showed an increase of available inventory to about 10 weeks but 2 bedroom/1 bath and 3 bedroom/2 bath categories went up to only 4 and 7 weeks respectively. June closings so far show that 26 2/1 single family homes closed with an average selling price of $1.26 million, 21 days on market, and premium (selling price/listing price) of 110%. There were also 30 3/2 single family homes that closed at an average selling price of $1.6 million, 18 days on market, and premium of 106% (selling price/listing price).

We should also quickly note the numbers of luxury homes has also increased and available inventory has risen to about 3 months for homes priced between $2.5 - $5 million and 6 months for homes priced over $5 million.

The condo market place is entirely different. During the same 14 day period a year ago there were 128 new listings compared to 333 this year -- a 260% increase. The biweekly to biweekly comparison is only 7% increase.

Typical for San Francisco you would find available inventory running from 4-6 weeks. With the huge numbers of properties coming on the market in just the last three 2-week reporting periods new inventory has totalled 913 units. Available inventory for homes priced below $1.5 million is 8-10 weeks; $1.5-$2.5 is 12 weeks; $2.5-$4.5 is 20 weeks; properties above $4.5 million jumps to 40 weeks.

Sold condos in June results are as follows. For the two largest categories of condominiums (1/1 and 2/2) there were 29 closed 1/1 units with an average selling price of $893k with days on market of 35 and a premium of 100%. For 2/2 units, 39 closed with an average selling price of $1.6 million, 37 days on market and a premium of 99%.

While buyers will find a broader array of residential properties available single family homes remain in demand and it appears that premiums will be between 2-8% rathether than the 10-20% we've seen previously. The condo market is under pressure from the sheer number of listings and we expect to see some leveling or lowering of prices given the history number of price reductions we've seen over the past 8 weeks.