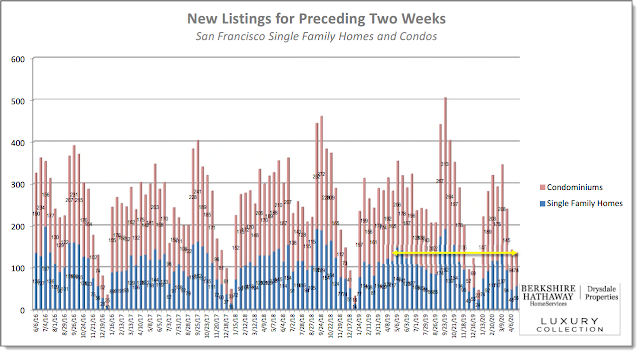

Just when you might have thought things might settle down now that we're well past the Labor Day holiday, the number of new listings in the past two weeks has increased to levels we haven't seen in at least seven years. Total new listings in the last two weeks were 718 of which 259 were single family homes and 459 were condos.

That total of new listings is 142% of the same period last year and 137% compared to the prior two week period.

Price reductions have also jumped -- 53 for single family homes and 173 for condos.

Those numbers are 171% of the number of price reductions for single family homes a year ago and 339% for condos.

You might conclude from these numbers that sales have taken a nose dive. But one of our other reports shows that the number of closed sales so far for September have exceeded the number that closed for entire month of September last year (140 compared to 127). Closed sales of condos so far this month are 187 compared to 191 for the entire month last year. So it appears that the sales rate hasn't changed significantly compared to a year ago -- it's just inventory that has climbed so dramatically.

The full reports can be found at out web site: