But, as the graph above illustrates, we should expect to see significant increases in the number of new listings for both condos and single family homes by our next report in two weeks following the Labor Day weekend.

The percentage of new listings going into contract is also about the same as it was for the prior two week period (6.3% vs 4.3% for single family homes; and 4.1% vs 2.8% for condos). However, for the same period a year ago those percentages were 12,9% and 14.8%.

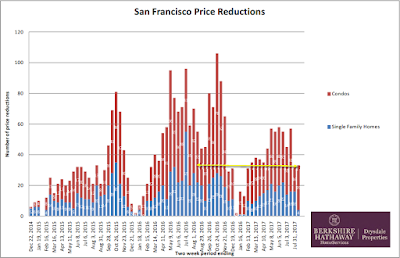

The number of price reductions is almost the same as the prior two-week period (5 vs 4 for single family homes; and 21 vs 29 for condos). A year ago those numbers were much higher: 20 and 24 respectively).